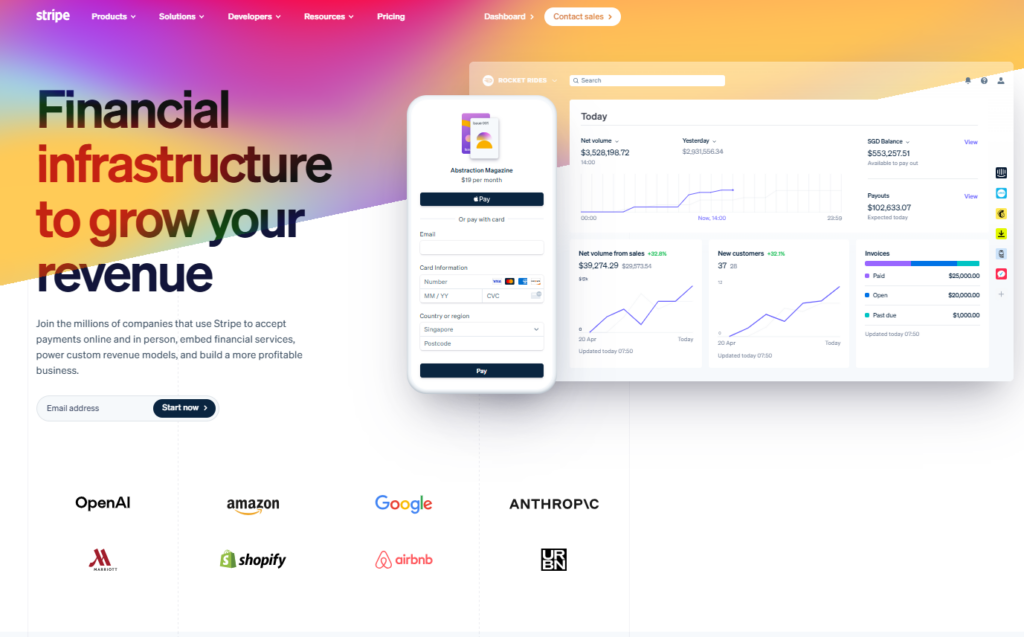

For many entrepreneurs running independent websites, e-commerce businesses, SaaS products, or digital content platforms, Stripe is one of the world’s top online payment gateways. It not only supports multiple credit cards and local payment methods but also offers excellent developer APIs and a seamless payment experience, greatly improving conversion rates and user satisfaction.

However, a common question arises: “Can I register Stripe without a US company? Is there a way to open an account legally and compliantly?” Based on Stripe’s basic rules, this article details mainstream feasible solutions, helping you evaluate the pros, cons, and key implementation points of each path.

I. Why Register Stripe? Who Needs It Most?

Even with alternatives like PayPal, Stripe remains a “must-have” for many businesses, mainly due to the following reasons:

1、Smoother Payment Experience

Stripe supports on-site credit card payments without redirection, reducing user churn. This is particularly crucial for high-purchasing-power users in European and American markets who are accustomed to direct payments.

2、Richer Payment Methods and Development Support

In addition to major credit cards like Visa and Mastercard, it is compatible with Apple Pay, Google Pay, and other methods. It also provides highly customizable APIs, making it suitable for SaaS subscriptions, complex billing, and platform payment scenarios.

3、Brand Trust Endorsement

In European and American markets, “Stripe Payments” itself serves as a trust signal, making it easier to gain the trust and payments of high-value customers.

Therefore, for independent websites and service providers targeting European and American markets and pursuing automated collections and high conversions, Stripe’s value goes far beyond that of a simple payment tool.

II. Complete Analysis of Feasible Solutions

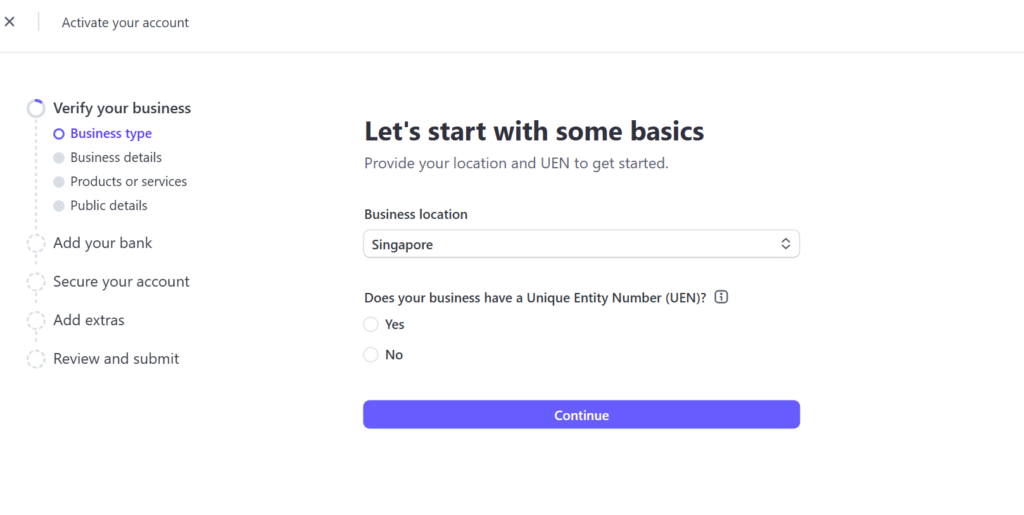

Stripe has strict compliance requirements for account holders: you must have a legitimate entity, a valid tax ID, and pass identity and address verification. While registering a native Stripe account without a US company is challenging, it is not impossible. We categorize feasible paths as follows:

1. Register a US LLC → Official Stripe Account

Target Users: Entrepreneurs with long-term business plans.

This is the most widely adopted solution in the industry:

- Register a US LLC (e.g., in Delaware, Wyoming, or other states).

- Apply for an EIN (Employer Identification Number) through the IRS.

- Link a US bank account for Stripe payouts.

- Submit company registration documents, address, phone number, and other information to open an account.

Pros:

- Fully compliant with high approval rates.

- Global payment acceptance without third-party restrictions.

- Facilitates future expansion of additional services such as PayPal and advertising accounts.

Risks/Challenges:

- Company registration and bank account opening involve time and costs.

- For individuals with no overseas business operations, Stripe may focus on verifying the business location during review. Strict requirements apply to the authenticity of addresses and identity information (e.g., virtual addresses may trigger audits).

2. Use a Company from Stripe-Supported Regions (e.g., Hong Kong)

Target Users: Those who want a compliant entity without registering a US company.

Stripe also supports account opening for companies from certain non-US regions (e.g., Hong Kong, Singapore). Registering a Hong Kong company and obtaining the corresponding tax ID and bank account is another common approach.

Pros:

- Exempt from US tax and certain regulatory burdens.

- The account opening process in Hong Kong is relatively familiar to mainland Chinese users.

Cons:

- Stripe may offer fewer features for Hong Kong accounts compared to US accounts.

- Hong Kong banks have relatively high account opening thresholds and may require on-site visits or authorization.

3. Stripe Official Invitation-Only / Partner Portals

For specific countries or industries, Stripe may open access through invitation-only programs (e.g., developer platforms, partner projects, or regional pilots).

Pros:

- Account opening may be possible without registering a company.

Cons:

- Unstable and uncontrollable, as it requires official invitation.

- Many restrictions, making it unsuitable for long-term, large-scale collections.

4. Third-Party Collection / Merchant of Record (MoR)

This is an alternative that does not involve opening a direct Stripe account. If you only want to indirectly use Stripe’s payment capabilities or collect funds without registering a company, consider Merchant of Record (MoR) services. These services handle compliance and taxation on your behalf, allowing global collections without a company.

Pros:

- No company or tax ID required.

- Simplified compliance, especially suitable for digital products or SaaS.

Cons:

- Higher costs (usually a percentage fee, e.g., 5%–10%+).

- Not a genuine Stripe account, so certain features cannot be customized.

- Limited control over customer information and payments.

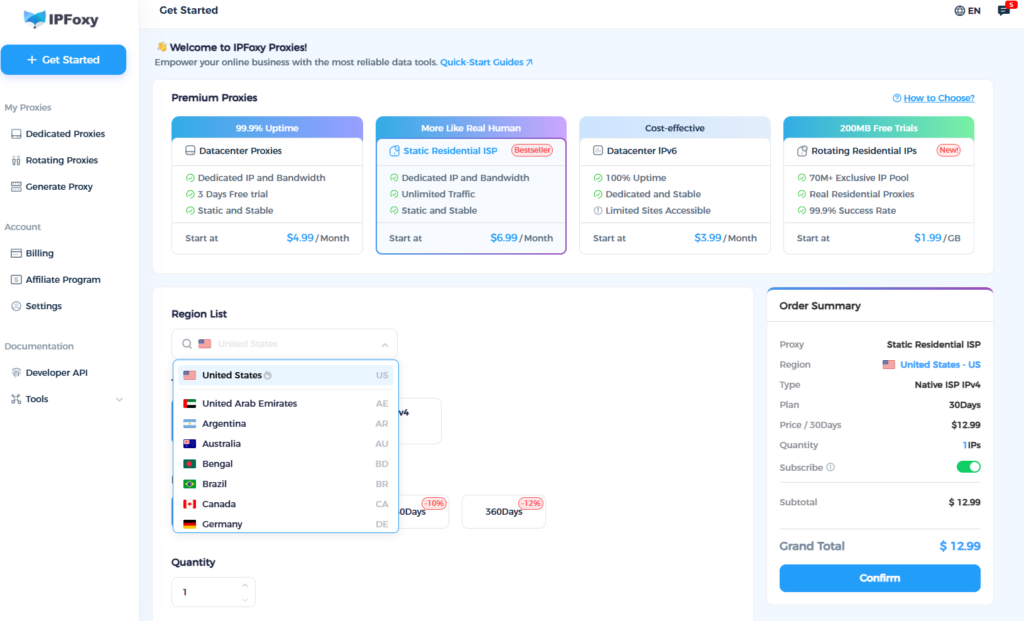

III. Key Notes on IP and Network Environment for Stripe Registration & Use

Many people assume Stripe only verifies company and identity documents, but network environment is an often overlooked yet critical factor in risk control.

Account restrictions or manual reviews may be triggered if:

- Frequently logging into the overseas Stripe backend via domestic or unstable networks.

- Using IPs shared by multiple users or flagged by financial platforms.

- Frequent IP changes when switching devices or environments.

Especially for sellers who register overseas companies but have no local US teams, long-term unstable network environments are likely to be deemed “high-risk remote operations,” affecting account security and payout stability.

In practice, many experienced sellers take a key step: configuring a fixed, clean overseas IP environment for payment backends, advertising accounts, and business systems to reduce unnecessary risk control variables.

In terms of collection and overseas business environment setup, IPFoxy offers a proxy solution focused on “long-term compliant operations”:

- Exclusive, non-shared IPs: Clean and stable, reducing the risk of being marked as high-risk nodes by payment platforms.

- Supports residential/static IP scenarios: Closely mimics real overseas user network environments, suitable for sensitive scenarios like Stripe backends, banks, and advertising systems.

- High stability: Ideal for long-term fixed use, avoiding login anomalies and risk control alerts caused by frequent IP changes.

- Covers popular country nodes for sellers: Easily matches reasonable network environments.

Summary

Registering Stripe without a US company is not impossible, but it must follow compliant paths: either register a legitimate company in the US or another Stripe-supported country, secure an official invitation/partner access, or use third-party collection services for indirect access. Each solution has its applicable scenarios and costs. You should make a careful choice based on your business scale, long-term plans, and compliance requirements.