In the early stage of running an independent website, common issues include “high collection costs”, “slow fund arrival” and “frequent risk control reviews”. Choosing the right payment tool directly impacts conversion rates, costs and capital turnover.

This article is tailored for newbies, breaking down 5 widely used payment tools in 2025 from four dimensions—fee rates & settlements, global coverage, main applicable scenarios, advantages and disadvantages—to facilitate your quick decision-making and practical operation.

I. Top 5 Most Used Payment Tools in 2025

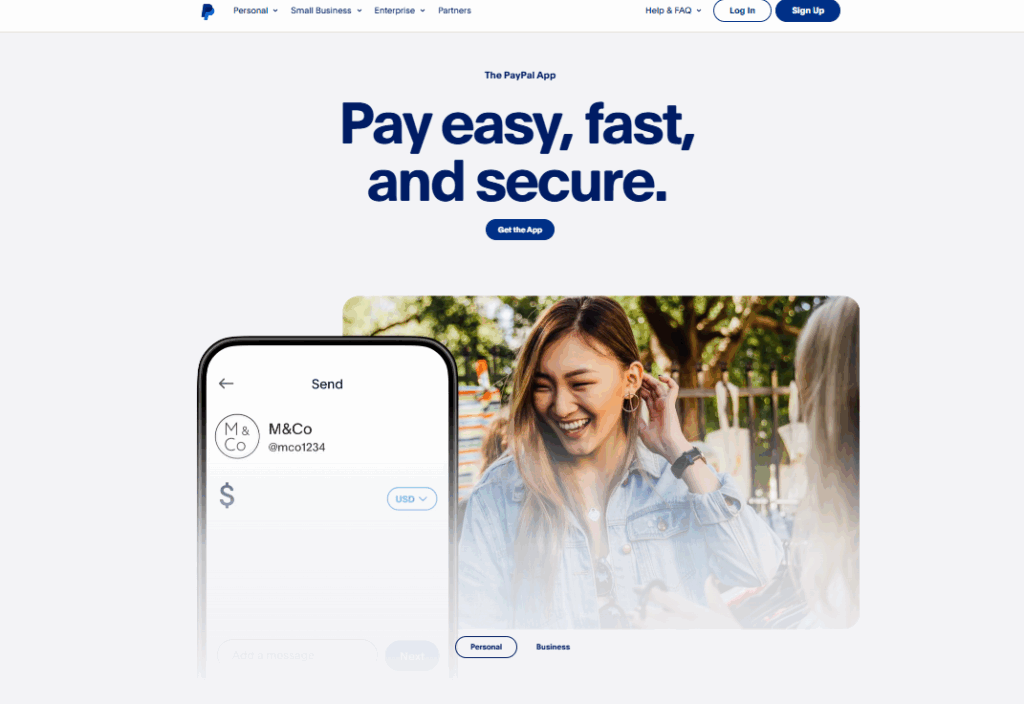

1. PayPal

One of the earliest and most well-known online payment platforms globally, supporting both personal wallets and merchant collections.

The common pricing structure is “fixed fee + percentage”, with additional fees usually applied for cross-border transactions or currency conversions (subject to the official fee schedule). PayPal adjusts rates based on countries and transaction types.

It boasts extensive global coverage and high consumer recognition, supporting both personal wallets and merchant accounts. Its large user base is its biggest advantage.

(1) Applicable Scenarios

B2C small stores, independent websites (PayPal Checkout), C2C/second-hand platforms, and small-value quick collection scenarios. High consumer trust significantly boosts checkout conversion.

(2) Advantages

Familiar and trusted by users, with a sound refund/dispute handling mechanism. Low entry threshold, suitable for newbies to launch quickly.

(3) Considerations

Cross-border fees and currency conversion fees increase costs. The platform leans towards protecting buyers, so refunds/disputes and temporary fund freezes can greatly impact merchants (complete documents are required to respond to risk control).

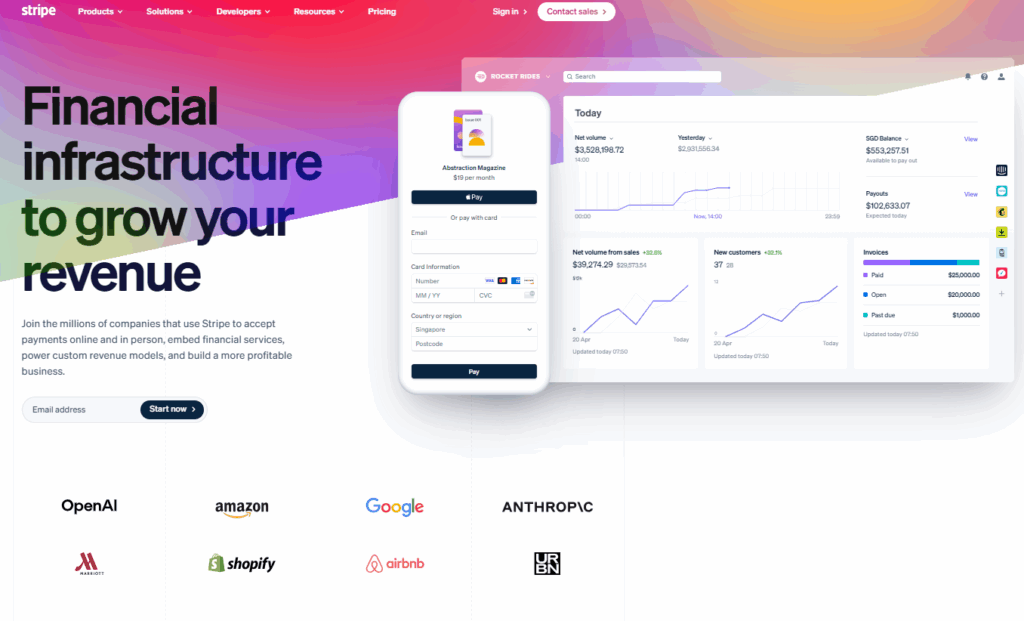

2. Stripe

Famous for being developer-friendly, offering powerful APIs and rich payment products (cards, local payment methods, subscriptions, Marketplace Connect, etc.). Suitable for merchants and platform-based businesses needing in-depth customization.

The standard pricing is a fixed fee + percentage per transaction (slightly varying by country/card type), with additional fees for cross-border transactions and currency conversions. It covers numerous countries/regions, especially developer-friendly, enabling quick integration of various local payment methods (cards, APMs, local wallets). Highly suitable for technical e-commerce/SaaS/subscription businesses.

(1) Applicable Scenarios

Independent websites requiring customized payment processes, SaaS/subscription models, Marketplace/platform settlements, and scenarios needing integration of multiple local payment methods.

(2) Advantages

Strong APIs, modular functions (subscriptions, split payments, risk control), and excellent local payment support. Ideal for technical teams or merchants needing complex settlement logic.

(3) Considerations

Strict requirements for KYC and compliance documents. Initial integration may be challenging for non-technical teams. High-risk cross-border categories still need to monitor chargeback rates and risk control strategies.

3. Payoneer

Specializes in providing local receiving accounts and withdrawal services for cross-border sellers, freelancers and platforms (supporting multiple currencies/local collections).

Account crediting often offers discounts or is free of charge. Withdrawals to local banks or cross-border transfers incur fixed or percentage-based fees (significant variations by currency/country).

Targeting freelancers, it covers many countries and supports multi-currency collections and local receiving account services (e.g., USD local receiving).

(1) Applicable Scenarios

Collection from Marketplaces such as Amazon, Upwork and Freelancer; cross-border B2B payments and receipts; sellers needing local bank crediting.

(2) Advantages

Local receiving accounts (USD/EUR/GBP, etc.) facilitate quick withdrawals. Seamless integration with major marketplaces, and withdrawal fees are more advantageous compared to traditional wire transfers.

(3) Considerations

Reviews are still conducted for large-value or abnormal activities. Small and frequent transfers may trigger fixed fees under new policies, so operators should consolidate payments to save costs.

4. Wise

Excels in low-cost cross-border transfers and multi-currency accounts, suitable for needs such as centralized foreign currency management and settlements.

Transparent fees, per-transaction pricing, and exchange rates close to the mid-market rate (fees vary by currency pair). Offers multi-currency receiving details and supports local crediting in multiple countries.

(1) Applicable Scenarios

B2B payments, supplier settlements, and small/medium-sized cross-border enterprises that need to convert overseas income into local currency or manage funds across multiple currencies.

(2) Advantages

Low fees, transparent pricing, support for multi-currencies and local receiving information. Suitable for frequent transfers and fund management.

(3) Considerations

Extra attention should be paid to compliance disclosure and refund handling. When using, keep abreast of local compliance information and maintain customer communication and document retention.

5. Adyen

Targeting medium and large brands and retailers, it provides enterprise-level payment processing, direct access to card networks and local networks, emphasizing global localization and high authorization rates.

Pricing is usually “fixed processing fee + payment method-related fees”, with customized pricing negotiable based on transaction volume/needs. Adyen emphasizes integrated access to multiple payment methods and transparent transaction visibility.

(1) Applicable Scenarios

Large e-commerce brands, cross-border retailers needing high authorization rates and local payment coverage, and enterprises seeking to cover multiple local payment methods through a single integration.

(2) Advantages

Enterprise-level risk control and compliance, coverage of multiple local payment methods, support for large-scale settlements and real-time reports. Suitable for brands expanding into multiple international markets.

(3) Considerations

High initial threshold for small and medium-sized sellers (integration and commercial terms are more suitable for customers with large transaction volumes). The fee structure may be more suitable for large-scale operations.

II. Actionable Advice for Newbies

1. Clarify Account Positioning

When using overseas cross-border payment tools, newbies should first clarify their needs:

- For personal consumption only: Maintain a primary account and avoid frequent device or environment switches.

- For store collections or team collaboration: Consider account stratification, isolation and environment management.

Clear positioning ensures a logical subsequent account structure.

2. Prioritize IP and Account Environment Isolation

In actual operations, payment channel risk control evaluates not only transactions themselves but also combines store environments (IP, device fingerprints, shipping addresses, historical behavior) to assess risks. For sellers operating multiple stores, multiple national sites, or testing local payment integrations in various regions, using compliant and secure IP proxy services + fingerprint browsers can reduce additional manual reviews or temporary risk control caused by abnormal environments.

Fingerprint browsers isolate device fingerprints and simulate real device environments to prevent account correlation. High-quality proxy IPs provide account IP isolation, ensuring each account has an independent, stable and unassociated internet environment.

In multi-account payment scenarios, IP quality directly affects risk control security. Poor-quality, shared or high-repeat-rate IPs are likely to be identified as suspicious traffic.

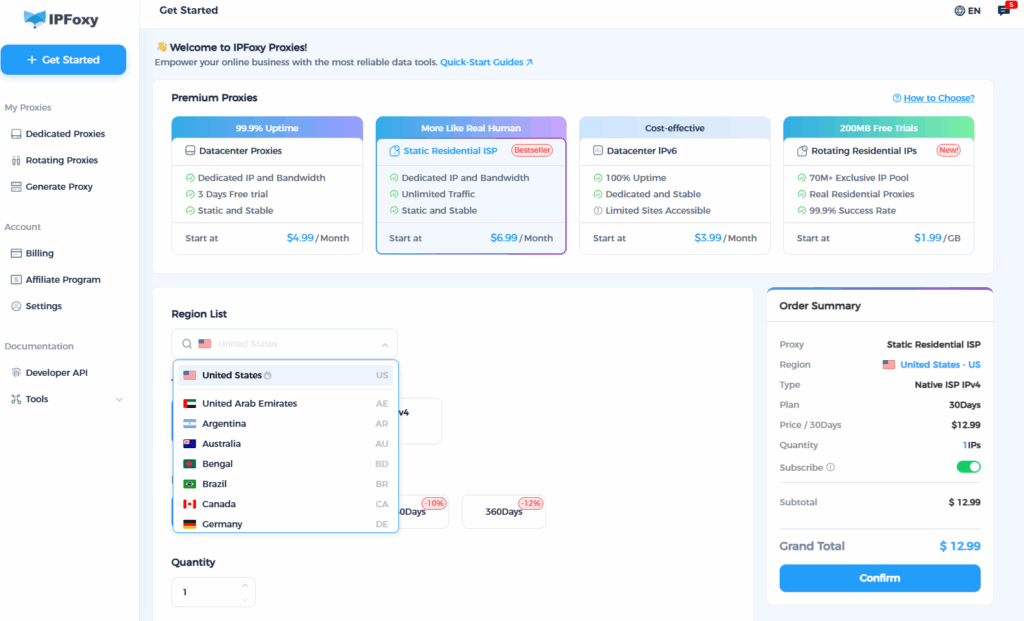

We recommend using IPFoxy’s residential proxies:

- Real home broadband exits with high cleanliness and no abuse records.

- Global coverage with city-level targeting, suitable for cross-border payment scenarios.

- Strong stability and good compatibility with mainstream anti-fraud systems.

- Complete “account environment isolation” when paired with fingerprint browsers.

3. Warm Up Your Account Before Large Transactions

Avoid large transactions immediately with new accounts. Follow this rhythm:

- Days 1–3: Complete basic verification, bind email and supplement information.

- Days 4–7: Process small-value collections or payments.

- After 7 days: Gradually increase transaction limits.

This is the best way to avoid amplifying “abnormal behaviors”.

Summary

- Prioritize the PayPal/Stripe combination: PayPal enhances consumer trust and conversion, while Stripe is irreplaceable for development and subscription scenarios. For independent websites, integrate at least one of the two.

- Use Payoneer for platform income: If your main revenue comes from Marketplaces, Payoneer’s local collection/withdrawal is more convenient with generally friendlier fees.

- Choose Wise for cash pooling/low-cost transfers: Cost-effective for daily cross-border payments and exchange rate optimization, but pay attention to compliance and disclosure.

- Consider Adyen for large-scale international expansion: Opt for Adyen when pursuing high authorization rates, enterprise-level local support and large transaction volumes.